Personetics Engage

Personalized Guidance for the Financial Customer Journey

Customer expectations from their

banking providers in the digital age go beyond just access to data and ease of use.

How will your bank respond to changing customer expectations in the digital age?

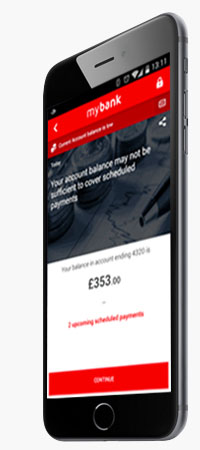

Personetics Engage is a new breed of banking solution, one that truly puts customer needs first. It provides timely and useful insights that keep customers informed and help them better control and manage their financial affairs. Using real-time predictive analytics to empower customers, banks can reestablish themselves as trusted partners to the consumer.

How Banks Use Predictive Analytics to Empower Customers

Engage transforms user-specific data streams (including relationships, transactions, location, and behavior) into personalized, predictive, and actionable insights delivered in real-time to each user through the bank’s digital applications.

These personalized insights include:

- Unusual account activity which may require an action (e.g. annual subscription renewal, unrecognized merchant charge)

- Spending patterns (e.g. how much I’m spending on dining out)

- Potential upcoming issues and actions I can take (e.g. insufficient balance prediction)

- Ways to avoid potential fees & penalties (e.g. what card to use out of the country)

- Services that would benefit me and simplify my banking (e.g. overdraft protection, automated payments)

- Offers relevant to my behavior, actions, and location (e.g. Foreign currency account for travelers / cross-border transactions)

- Personal advice to improve my finances (e.g. how to save more based on my cash flow patterns)

How it Works

Benefits and Results

Using Engage, Banks are able to:

- Increase customer engagement by providing contextually-relevant insight and advice

- Offer products and services which anticipate and meet customer needs

- Jumpstart customer adoption from day one – no lengthy data entry or setup needed

- Seamlessly adapt to user preferences while retaining the ultimate control

- Accelerate time-to-market with pre-built tuned and tested financial services knowledge

The results speak for themselves:

To Learn More

Personetics is working with some of the world’s leading banks that are now realizing the potential of personalized digital banking.

See how Personetics can help your bank increase customer engagement across digital channels.

![]()